'Customer Wallet Present' won't just transform digital banking, it's going to revolutionise the digital economy

How a clever new anti-fraud feature from the UK banks might just completely transform our online interactions

Hi everyone, thanks for coming back to Customer Futures.

Each week I unpack the fundamental shifts around Empowerment Tech. Personal AI, digital wallets, digital ID and customer relationships.

If you’re reading this and haven’t yet signed up, why not join the growing number of executives, entrepreneurs, designers, regulators and other digital leaders by clicking below.

To the regular subscribers, thank you.

Hi folks,

Another Deep Dive for you. About how digital trust, and especially fraud, is completely different when we can see, hear and feel the customer.

We’re going to talk about a world first, and how it’s come from a bank. Which is odd, because they say that “banks want to be first to be third.” They are almost always fast-followers, waiting until innovation is proven before rolling it out.

But this new anti-fraud feature is quite a breakthrough. Not only for the banking sector, but for the rest of the digital economy.

And just for good measure, you’ll also find out how it’s going to grease the wheels for managing the risks around AI agents more broadly.

It’s a Big Deal.

But the banks haven’t noticed yet.

All you need to do is look at digital wallets the same way we look at credit card transactions.

So grab your caffeine shot of choice, and Let’s Go.

A few weeks ago, I wrote about Organisation Identity, or ‘OI’. It’s the next great identity market. 100 times bigger than IAM, CIAM and SSI combined, and likely one you’ve never heard of.

Today, I want to point to a related but different opportunity.

Using digital wallets to fight fraud on the customer side.

New phone, who ‘dis?

Online fraud is exploding. I won’t litter this post with the latest astronomical stats, other than to say that it’s already a $50bn problem and expected to grow 141% over the next five years, according to Juniper Research.

Personally, I think that’s an understatement. Fraud is going to get much worse once AI Agents kick in. But let’s not just look at the huge, depressing numbers. Let’s look at how fraud looks and feels.

I recently received a call from my bank’s fraud team. It turned out they were checking (correctly) that I had approved the movement of some larger-than-normal funds. But I spent a good ten minutes on the phone with them, getting them to convince me it really was My Bank calling.

I was checking that they were who they said they were.

Of course, I was playing with them a little. Knowing that in the end, I’d simply call the bank’s official phone number to reach the same team. I’d never take a call directly from the bank.

But I wanted to find out what happened when I challenged them on their identity, not mine.

You see, when you’re on the phone with the bank, they aren’t allowed to talk about any of your personal details, or your account info. Or ironically, the very fraud that they rang you to talk about… until you can prove that it’s really you.

Until you can ‘pass security’.

But of course, it’s a catch-22. By proving that it’s really you - using your personal data and doing some ‘knowledge-based authentication’ - you’re doing the exact thing that the fraudsters want you to do.

Handing over the very personal information the baddies need to pretend to be you in another fraudulent transaction.

So we’re in a bind. And it’s no surprise that when the ‘bank’ calls, and customers are put on the spot, most people just hand over their account information to prove it’s them. And sadly, their personal data is then later used to commit fraud.

But there’s been an exciting market development. Well, exciting for banking.

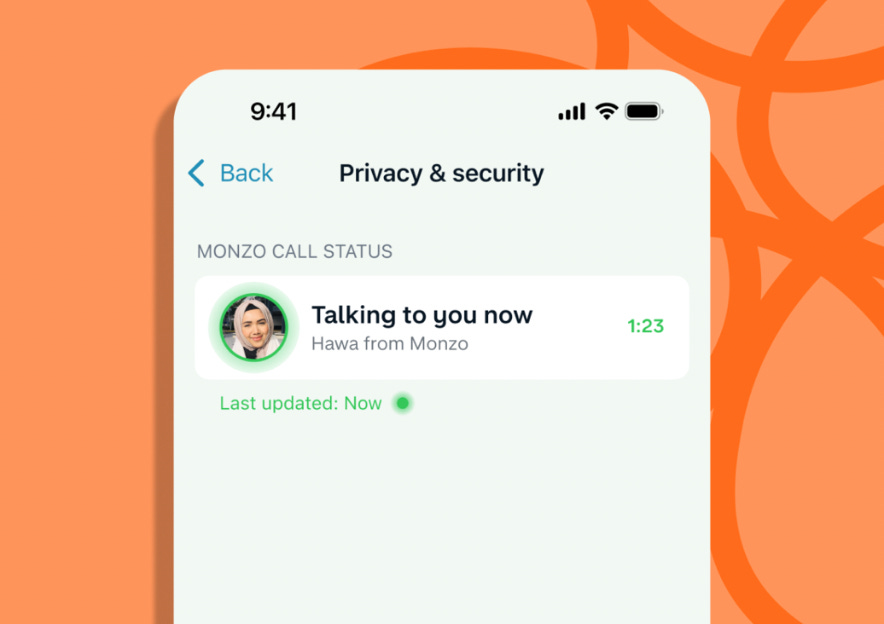

A few UK banks, pioneered by the increasingly brilliant and digital-only bank Monzo, have launched a very simple and effective anti-fraud feature.

It’s called ‘Call Status.’

It’s one of those drop-dead obvious features that you look back on and question why it wasn’t done years ago.

What does it do?

If a suspicious call comes in from your ‘bank’, you can just open your bank app and look at a new 'Call Status' icon, live in the app.

Green means “Yes, we’re on the phone with you right now”. And orange means “We're NOT talking to you right now… so if someone calls saying it’s the bank, then hang up".

Neat feature.

But let’s look at this differently.

Please hold caller

I’ve written before that Digital Wallets Are The New Accounts. And they have the potential to become a New ‘5th Channel’ for business.

What does that mean?

Customers will soon be able to ‘connect’ their digital wallet to their existing accounts. The wallet can become a companion app for all the businesses you deal with. Including your bank.

It takes the digital wallet concept way beyond tokens, NFTs, digital assets and funky artwork. The wallet can now become an authentication channel. A messaging channel. And a new verified customer channel.

Let’s look at this ‘Call Status’ thing again, but this time through the lens of a connected digital wallet.

When your bank calls, they can send you a verified message, directly to the digital wallet associated with your bank account, which can say “We’re on the phone to you right now.”

Remember: your digital wallet has been privately, digitally and securely connected to your bank’s protected systems. So you can instantly know that it’s the bank calling.

But let’s go further.

We can also use this connected wallet feature in reverse. The bank can instantly check that it’s you calling them.

So when I phone the bank’s contact centre to discuss an overdraft or whatever, when I need to ‘pass security’, the call centre agent can simply ping my digital wallet to confirm it’s me on the phone.

My wallet then wakes up and asks me, ‘Are you on the phone to the bank right now?’

I tap ‘yes’… and I’m in.

What used to take 60 seconds now takes 6 seconds.

No more silly (and easily guessed) questions from the contact centre agent. No more confirming my date of birth. No more ‘first line of your address’. No more mother’s maiden name. And no more crappy and insecure ‘one-time passwords’ (looking at you, SMS).

Amazing.

Once businesses realise the power of this new verified digital connection, I’m betting that every company - not just the banks - will want to add this helpful feature to their customer experience. Or indeed, to let customers choose which digital wallet they want to use for the ‘Call Status’ feature.

I can imagine entire industries like banking or insurance coming around to this idea. If they can agree on the liability and authentication rules (how do you know it’s really Jamie tapping ‘Yes’?), then each sector could unleash its own universal ‘you’re on the phone with X’ protocol for the whole industry.

No more need for ‘my voice is my password’, or storing all that biometric information in a datacentre somewhere. In reality, it would be a simple open API call, available to any bank, any company, or even any individual business department.

For once, the banking sector has done something pretty market-leading. Well, at least Monzo and some other fast-followers in the UK.

But we can go further.

A new paradigm: Customer Wallet Present

With me so far? Great. Now hold on to your hats.

Because the knock-on implications of ‘verified customer connections’ using digital wallets are profound. Especially when it comes to managing customer risk and fraud.

Let’s take a minute to look at credit card payments, so I can show you how important the ‘verified customer wallet’ thing could be.

Today, when you pay with a card over the phone (so-called ‘Card-Not-Present’ transactions), the business can’t physically see you. So there’s a higher chance that it’s fraud, with someone else using your credit card details without your knowledge. This leads to ‘charge backs’, when the customer disputes a payment.

As a result, the payment processing companies charge the business a slightly higher fee for ‘Card-Not-Present’ (CNP) transactions.

But when you are physically in the store or shop, any card payment made is considered ‘Card-Present’. It’s less likely to be fraud, and therefore lower risk.

So the payment processing companies can charge a lower fee to take the payment.

Here’s where I’m going with this. We can now do the same with digital wallets.

When a customer interaction involves an approved digital wallet, one already connected to the verified account, then the customer MUST have been involved. Assuming we do the right checks on the wallet side - like asking for a selfie biometric - then the customer must have approved the interaction or transaction.

If we use a digital wallet to check that the customer is present, it will be much harder for fraud to happen. Much harder for fraudsters to trick the business. And therefore lower risk, and lower overall cost to the company.

Let’s call this ‘Customer Wallet Present’. And for the opposite situation, where the customer’s digital wallet isn’t involved? Let’s call that ‘Customer Wallet NOT Present’.

The wallet-less transactions will be exposed to much more fraud, and will carry more risk. And therefore will cost the business more.

You can now see that digital wallets have the potential to disrupt the very economics of customer risk management and fraud.

Now, look at this from the point of view of AI agents doing stuff for you. Booking, registering, updating your details. And indeed, making payments.

If an AI Agent can’t prove that it’s come from a verified digital wallet connected to the customer, then it’s very clearly ‘Customer Wallet NOT Present.’

In other words, yes, any old AI Agent can present personal data about me, but the business shouldn’t accept it as-is - and treat it with suspicion - until other checks are made. They should certainly treat that data as ‘high risk’ in their systems.

You see, this digital wallet approach won’t just be useful in the banking sector. It has the potential to transform fraud across the digital economy full stop.

Why?

Because over time, digital wallets will crowd out the fraudsters.

Yes, bad actors will have their own fake wallets and fake AI agents and all the rest. But they won’t have Customer Wallet Present. Meaning fraudsters will have to move over to less trusted channels, like SMS and email.

Making the connected digital wallet even more valuable to the businesses.

‘Verified customer connections’ are why I’m bullish on digital identity wallets. Not just because I can carry around and share my digital ID and other personal data easily. But because I’ll also be able to use it across all my customer relationships, and in any channel.

Online. On the phone. In branch. And with my AI Agent.

Yes, we’ll need to make sure that the right person is approving transactions on the digital wallet. But with biometrics stored (and kept) on the device, that’s a damn sight easier than making sure it’s the right person accessing your account with a password.

Your digital wallet just became your first line of defence.

Your digital wallet just became ‘RegTech’.

With a digital wallet, I’ll feel safer and more confident to interact with a business. Especially when I need to move my money around. Plus, it’s a bonus for my bank’s fraud team, who can stop faffing about with all those pointless questions about my cat’s favourite colour.

In fact, if my bank - or any other business for that matter - doesn’t accept my wallet as a new, trusted channel, then me and my AI agent are going to take my business elsewhere.

Because digital wallets won’t just help fight fraud. They’re going to become a competitive advantage.

And that’s a wrap. Stay tuned for more Customer Futures soon, both here and over at LinkedIn.

And if you’re not yet signed up, why not subscribe:

Brilliant Monzo feature.