Did Visa just change the identity game with a 'Flexible Credential'?

Your payment card just became the gateway to the contents of your digital wallet

Hi everyone,

Thanks for coming back to Customer Futures. Each week I unpack the fundamental shifts around Empowerment Tech. Digital wallets, Personal AI and new digital customer relationships.

This is a PERSPECTIVE edition, a regular take on the future of digital customer relationships.

If you’re reading this and haven’t yet signed up, why not join over two thousand executives, entrepreneurs, designers, regulators and other digital leaders by clicking below. To the regular subscribers, thank you.

I’m at the EIC conference in Berlin this week. Lots happening, and a digest on that coming soon.

But this week I wanted to dive into Visa’s recent announcement about ‘Flexible Credentials’.

If they can get it right, it may be a Big Deal for us all. Across payments. Across digital identity wallets. And across the UI/UX for interacting with businesses.

Why?

Because they just made the card a digital wallet. Not within the card itself. But it might feel like it.

I don’t know enough about payments to provide an in-depth breakdown. So I’m turning to Simon Taylor, one of the most important FinTech voices right now.

His latest take on the Visa announcement is the best I’ve seen. And important for those watching the Empowerment Tech market.

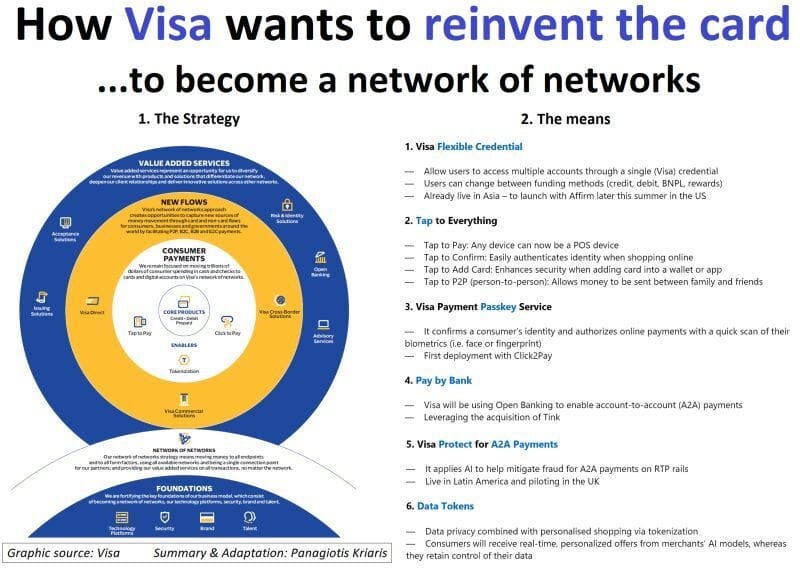

So with Simon’s permission, I’m resharing his Visa analysis directly from his weekly Fintech Brainfood ‘rant’. Note that it includes a visual of Visa's plans and analysis by the excellent Panagiotis Kriaris. Plus I’ve added my own observations and questions at the end, with the Empowerment Tech angle.

This feels like one of the bigger tectonic shifts in the wallet market. Where identity and payments collide.

Simon does point to some issues around wallet openness, and Visa’s ability to execute. But we can get to that another time. If Visa is successful, it feels like a real moment in the digital wallet market.

If you care about where all this is going, I strongly recommend signing up to Simon’s weekly Fintech Brainfood newsletter. He’s my go-to on all things FS, payments and disruption, and consistently provides some of the smartest takes in the industry.

And while you're at it, check out Panagiotis Kriaris's LinkedIn feed and insights. He's a master at finding the signal in the FinTech noise.

I’d love to hear your thoughts, comments, challenges and questions.

So grab a coffee and a comfy chair.

And Let’s Go.

Visa's Flexible Credential is a Gamechanger

For payments to not suck, they must work on any payments rail in any market and optimize for price and rewards.

Consumers would have zero friction and global payments. Merchants would trade off low-cost or higher conversion to suit their needs.

All of that would happen automatically.

This seemingly simple ambition is incredibly hard in practice because we have evolved payment systems over decades that

Suit different commercial incentives (banks, networks, merchants)

Are built on legacy technologies to solve a problem at the time (like ACH displaces cheques, credit cards displace merchant and Bank owned card brands)

Operate nationally or within closed (or closely controlled) networks.

Payments are fundamentally not interoperable, global, and rarely instant.

Cards don't work with ACH, and they don't really work with cross-border.

It's all a giant hodge-podge of companies trying to make the best of a mess.

But what if any card or wallet could help you navigate any payment type or sign any contract?

What if the route your payment was taken down was optimized right at the start?

That's exactly what Visa just announced.

Enter: Visa Flexible Credential

The Visa Flexible Credential allows a user to switch between debit and credit on a per-transaction basis. Put another way, if you're a card issuer (Bank, Fintech, or in embedded finance), you can now:

Add lending to that card.

Allow the user to route the payment to another card to optimize rewards.

In a sense, it allows one card to rule them all.

Unpacking the card credential

This excellent tweet from Terry explores (paraphrasing below)

A "tap-to-pay" or swipe is a legal agreement to make a payment from an account you hold to a merchant via a payment method (e.g., credit, debit, or BNPL).

New: A tap now also points to any other payment method. Your "tap" could point to any account or wallet. A payment for Gas could automatically use your fuel card, airlines use your Airmiles card, Grocery, Amazon Prime for 5% cashback.

Next: This empowers wallets to "auto select for you." Imagine if CashApp, Venmo, or your Neobank would auto-select the right credit, debit, or pay-by-bank rail based on the rewards you'd get. (Similar to how Kudos from this week's four Fintech companies works.)

That's cool, but what if a card credential could do more?

The best payment rail for the transaction empowers wallets and merchants.

Visa also announced this week that it's launching pay-by-bank in the US via its open banking acquisition, Tink. Pay-by-bank could be a meaningful competitor to cards. It offers merchants lower costs and potentially less friction for consumers, especially in use cases like bill pay or account funding.

Think of it like Open Banking Initiated Real-Time Payments. As a consumer, you would see an option at checkout, online or mobile, to connect (via Plaid or competitors) and share your ACH details to begin a transaction (An excerpt from Pay by Bank is the next big payment rail.)

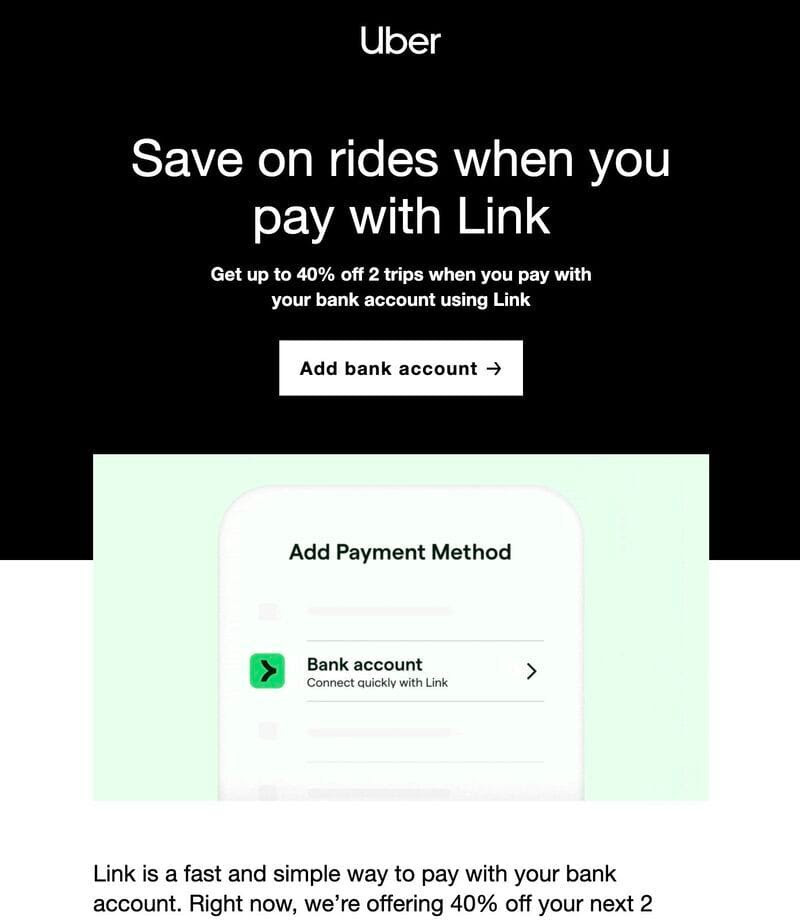

If you've tried to pay with Airbnb, X or Uber lately you might have seen a new SMS service from Stripe appear called Stripe Link.

As soon as you hit checkout, Stripe asks you to use Link and once signed up, you authenticate with an SMS, and you're done. This has two benefits.

It's often faster than inputting card information (even when stored)

It offers a second factor of security (through the mobile device), like a low friction 3D secure.

So far, so good.

The biggest barrier to the adoption of Pay by Bank will be acceptance at the physical point of sale. If only there were some way to make cards compatible with Pay by Bank.

Combining flexible credentials with Pay by Bank at the point of sale makes a new payment method possible.

In the future, merchants will be able to use any card to initiate a payment via any rail. They'll trade off the price of the rail (e.g., Pay by Bank is cheaper vs. Credit or BNPL) for the conversion of the user (e.g., BNPL may convert higher).

Consumer wallets and branded checkouts will compete for which rail and payment method appears first.

Flexible Credential and Tap to Anything also enable default global.

The problem with card rails is they're as big as the network. Visa's network is its strength, but it is also limited. Credit cards aren't fully compatible with Pix, UPI, Grab Pay, or Alipay (unless it's by exception). That means the "it works everywhere" proposition breaks down if you travel across India or APAC.

A flexible credential could steer a payment to those international wallet and RTP payment methods.

If the flexible credential, sitting in a wallet or app, could steer to other payment types or use a bridge like stablecoins, things get a lot more interesting.

(Read more in the US Dollar rail for non US citizens.)

Tap to anything opens the apeture.

If a flexible credential is an agreement to pay a merchant and payment rail selector, could it also be a legal agreement to do and sign other things?

Change that equation to an agreement to:

Rent a car + Pay according to the contract?

Book a hotel + cover incidentals automatically?

Sign a subscription agreement?

Sign a loan agreement and set up a payment schedule?

Pay for entry to a nightclub?

Act as a ticket to a sports stadium?

Book a flight and select the best card for the job?

Now, add all of the loyalty and payment rail benefits.

Passkey support makes cards a password.

Do you hate managing passwords? Me too.

Big tech companies like Apple, Meta, and Google, as well as password managers like LastPass and OnePassword, aim to solve that with passkey technology.

TL;DR - it's a standard way to use your device to authenticate (e.g., with Biometrics) for login and authentication.

Now imagine if any payment credential (what used to be 16 digits and is now a token) could operate as a passkey. Not only could you log in with your card to third-party services, but you could also link payments to them instantly.

Imagine hitting checkout, and your phone notifies you. You use a Passkey to authenticate that payment (or any other kind of contract or agreement).

Data tokens are the final piece of a wallet puzzle.

What makes BNPL special is its ability to use checkout and buying behavior data to generate offers and discounts for app users. They blended Fintech with Ad Tech to attract more shoppers to merchants.

Making this a network-level capability means any wallet could operate like a BNPL provider and surface future shopping offers, and give bigger loyalty and rewards.

When you consider Chase just launched an advertising business, this doesn't seem so far off.

Do the Visa announcements enable Banks to become wallets?

The incredible Jareau Wade described the flexible credential as enabling banks to compete with Apple Pay.

One of the benefits Apple Pay has held over other types of consumer wallets is the ability to authorize/initiate transactions via fingerprint or facial scans using a consumer's phone, leading to lower fraud and dispute rates and as a result higher authorization rates.

Put the pieces together, and there's a solid argument for it.

Payments: Apple Pay works by having users use their Biometrics whenever they click to pay. Passkeys, flexible credentials, and the click-to-pay feature create the same experience as Apple Pay.

It also brings other wallet-like capabilities that have become a default for companies like PayPal and Apple-like:

Card activation: Tap your card to your device to activate it when receiving it.

Confirm a transaction: Click pay online, and confirm quickly with device biometrics.

Ticketing: The "tap-to-anything" means airlines or sports stadiums could use the wallet as a place to store and issue tickets

Visa suggests this would be available via a bank's existing mobile app and turns what is largely a servicing screen into a true wallet.

Or do the announcements mean Neobank Wallets displace banks?

The value of this app is that it aggregates multiple cards together. Is Citi really going to let you put your Chase Sapphire card in the same wallet and send transactions to it?

Fintech wallets, however, have a different model. They're not trying to win deposits to fund lending activity. Their aim is to be the most engaging and useful wallet and to win permission to cross-sell to them.

A decade ago, card issuers talked about being "top of wallet." Now, it's about being the wallet. CashApp, Venmo, Chime, and others are now much better placed to compete with Apple Pay.

The bear case.

I'd split this in two

Execution Risk

Competitive Risk

1. Execution risk. Announcing products is one thing; delivering them is another. Visa has a long history of announcing wallets and solutions that amount to little more than a press release.

This, in particular, was disheartening.

Visa's marketing materials imply that Visa Payment Passkey Service will only be available via Click to Pay, Visa's proprietary online checkout experience, which is primarily deployed outside the US.

That's not the move of a network of networks. The Passkey should work with every branded checkout and every app. There are probably some good technical limitations here, but I'd still want this to be as open as possible.

2. Competitive risk. Visa is far from the only card network or payment rail. Mastercard will have an alternative; Capital One and Discover will be a part of the conversation, and merchants must be convinced.

Mastercard owns Finicity, which has a much larger open finance market share than Tink. They also own Faster Payments in the UK (so they have experience operating RTP) and have always done well internationally.

Visa's frenemies in this strategy are wallet providers and branded checkouts like Apple Pay, Shop, PayPal, and CashApp. Those companies have the most to gain from identity, payments, and signing, which are wallet-centric rather than network-centric.

Venmo could steer a consumer to use pay-by-bank to fund a wallet instantly and then make an "on us" transaction to payout the merchant. That would be a wildly more profitable transaction as a closed-loop payment.

The commoditization of the issuer.

Of course, the big banks are a massive part of Visa's business, so it makes sense that they'd focus on banks as the winners in their marketing, but I have a different take.

The card and the bank are being commoditized. The losers will be the card issuers (banks) that don't aggressively adopt a wallet strategy. In this light, the bank's Paze initiative makes a ton of sense.

The short-term winners will be the Fintech wallets that can execute and use the new capabilities. If your wallet can help you optimize rewards, select a payment rail based on the best cost/benefit for you or the merchant, store your identity, and sign contracts, it will become 1000x more useful.

Tokens, credentials, passkeys, and data all exist at the network level, and operating on multiple rails is the future we want.

There's a long road between announcing something and using it at scale.

But.

Kudos to Visa for the most compelling set of product announcements in Fintech I've seen in a long time.

ST.

Thanks Simon. This is a Big Deal, and certainly a shift in the payments world. But what about the implications for the digital identity wallet and Empowerment Tech?

I have some questions. Let’s start with what Simon said here:

“If the flexible credential, sitting in a wallet or app, could steer to other payment types or use a bridge like stablecoins, things get a lot more interesting.”

Question 1: If the flexible credential comes from a digital wallet, then could the user select other payment types AND other identity credentials?

He then said:

“If a flexible credential is an agreement to pay a merchant and payment rail selector, could it also be a legal agreement to do and sign other things?”

Which takes us to:

Question 2: Could that legal agreement be a simple data exchange, like an onboarding flow, including a customer signature with terms and conditions?

Let’s go further. Simon mentions some example flows that now become possible:

Rent a car + Pay according to the contract?

Book a hotel + cover incidentals automatically?

Sign a subscription agreement?

Sign a loan agreement and set up a payment schedule?

Pay for entry to a nightclub?

Act as a ticket to a sports stadium?

Book a flight and select the best card for the job?

Each of those flows requires identity of some sort. Or at least some form of reputation credential. That could easily be a verifiable credential, indeed from the same digital wallet. For example

Proof of insurance

Proof of age

Proof of subscription

Proof of ownership

Proof of country-entry visa

Proof of loyalty points membership

All of this is possible now.

And I’ll go further, it’s the express design of the new EU Digital Identity wallet to include not only ‘identity’ credentials, but all sorts of other credentials too, like those above.

Question 3: Is this the perfect opportunity to bring together digital identity and reputation into the payment flow?

Because Simon points to the following:

“Making this a network-level capability means any wallet could operate like a BNPL provider and surface future shopping offers, and give bigger loyalty and rewards.”

OK, now we have a ball game. The card just became the gateway interface to the digital wallet interaction.

The customer can tap-to-pay (really, ‘tap to prove’) and it triggers a wallet interaction. Including the customer’s payment method of choice. But also trigger the sharing of an identity credential from the same digital wallet.

I see this as the inevitable arrival of Embedded Identity.

The FinTech sector has been getting excited about ‘Embedded Finance’ for a while. Where payments can be embedded into any interaction.

Embedded Identity does the same, but rather than enabling a payment, it’s about proving facts about us. Sharing identity information in any digital transaction (and in a privacy-preserving way, of course).

Once the Visa wallet flow becomes a ‘network level capability’ (as Simon suggests), then we just got Identity Embedded into any payment transaction we want.

Sharing membership details. Reputation. Loyalty information. Or other facts about me like proof of age or VIP status or whatever.

To improve the customer experience, reduce fraud, or enable personalisation. And where needed, help merchants stay compliant for e.g. an age check.

Did the payment card just become the gateway to the contents of your digital wallet?

Maybe.

But Visa’s new ‘Flexible Credential’ - if tied to a digital wallet holding identity credentials - could finally become the payments+ID flow we’ve been waiting for.

Thanks for reading this week’s edition. And thanks to Simon for permitting me to share his take on Visa.

Do stay tuned for more Customer Futures soon, both here and over at LinkedIn.

And if you want to learn more about the future of Empowerment Tech, digital wallets and customer engagement, then why not sign up:

Sharing Identity information.

With the exception of situations like tying identity to a boarding pass, any interaction (including payments) should be a anonymous as cash. Payment system retained payment record &identity data should be confidential to the user unless they expressly consent.

Proof-of an identity attribute (age) or certificate (valid passport from 《jurisdiction》) vs sharing. Ideally biometrics proofs are done by your device (with appropriate crypto signatures) which exchanges the proof record to the requesting party vs a gov face-recognition system.