Digital wallet lipstick on a pig, consent is dead, and private AI happens when you start with developers

Plus: There won’t be just one EU Digital Identity Wallet, the UK is NOT introducing ID cards, and bypassing digital wallet payment security for free shopping.

Hi everyone, thanks for coming back to Customer Futures. Each week I unpack the disruptive shifts around digital wallets, Personal AI and digital customer relationships.

If you haven’t yet signed up, why not subscribe:

Another excellent week for Empowerment Tech. And another opportunity to pick out some of the ‘ET’ nuggets you might have missed.

Designing for digital wallets. Tracking people online. The issues with digital consent. mDLs and Google Wallet. And thinking about how digital privacy gets implemented in businesses.

Lots to track, and lots to make sense of.

It’s all about keeping an eye on the future of being a truly digital customer. So welcome back to the Customer Futures newsletter.

In this week’s edition:

Putting lipstick on a pig - are you missing the real digital wallet opportunity?

A masterclass argument: Consent is dead

No, the UK government isn't planning to introduce ID cards

Privacy-Preserving Corporate Information Sharing (PPCIS) - a breakthrough to make you think

Private AI happens when you start with developers

… plus other links about the future of digital customers you don’t want to miss

Let’s Go.

Putting lipstick on a pig - are you missing the real digital wallet opportunity?

Sarah Drummond is a powerhouse service designer. At the forefront of transforming digital services in the UK for years.

She recently wrote a brilliant piece about the difference between making small changes to an experience vs genuinely transforming the business.

Here’s a snippet.

“Tinkering can help us improve outcomes. Sometimes it's ok to do this, and sometimes you have to do this because all design exists within constraints. This might be the business model, regulatory environment (for good or bad) or culture. Sometimes, the only way to help users is to incrementally improve the service model that exists.

“But good, great service design exists when you can transform the service and what you offer. Re-think why the service exists, come back to first principles and what that service is there to do to help users with, change what it helps people to do, and transform it's overall model of delivery.

“This is stepping back and really thinking about what users might need or could be supported to do.

“So much of our services these days are defined by legacy IT, particularly in public services. It's formed a basic transactional service delivery model that is so imprinted in our minds we find it difficult to think of how to design and deliver services in any other way. Even the explosion AI tools are being applied into broken chat bots on websites. Same old service model, no transformation.”

My observation here is that’s what is about to happen - already is happening - with digital wallets.

Just as Sarah notes is happening today with AI. We’re applying new tech to the old service.

Login. Authenticate. Form fill. Digital checkout. Badges.

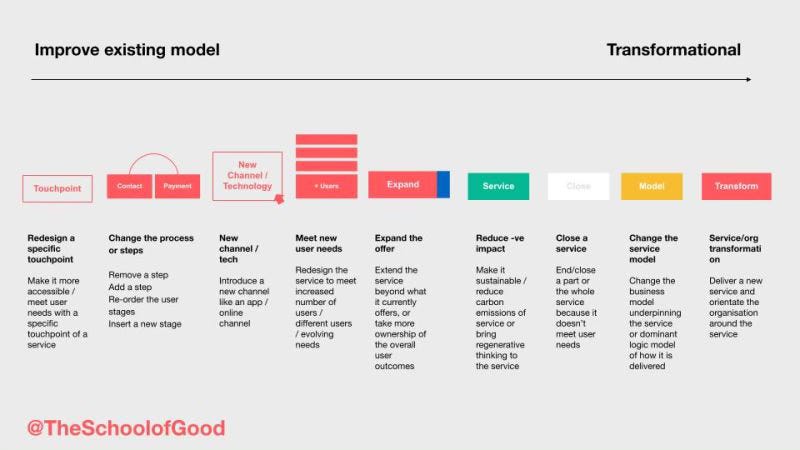

Here’s the picture Sarah uses to show the wide spectrum of design improvements available to us. If you are honest, which of them are you really going after? What do you really think will happen with digital wallets?

I’d argue that most digital wallet projects are hanging out somewhere on the left-hand side of the chart.

But it’s worse than that.

Look closely at each of the design opportunities. Even at the most transformational, they are about improving the business.

Yes, the best designers will improve a product or service to meet user needs. But where are the businesses designing services that exist on the customer’s side? Helping the buyer buy, not just helping the seller sell?

Here’s what I mean.

The banks too often map the customer journey as the steps starting from ‘I need a mortgage…’ through to ‘…I have a mortgage’. They don’t see the stuff before or after.

It’s more like ‘…I think I may need to move home…’ all the way through to ‘…I’ve moved in and the broadband doesn’t work, I don’t have a fridge and I have to spend three weeks letting all those companies know I’ve changed address’.

And the shoe company too often sees the customer journey starting with ‘I need some running shoes…’ and ending with ‘…I have some running shoes’.

Not ‘My sister died last year, I’m finally doing a charity run but I’ve never been running before, I’m a wreck, and need to learn what I should wear and how to train.’

My goodness. Imagine the businesses that could step in to help you with those life journeys. Those moments that matter?

Designed properly, transformationally as Sarah writes about, wouldn’t those services be remarkable? Wouldn’t they be something lots of people would pay for?

So two things to think about.

First, are you applying your clever new Digital Wallet solution to an existing customer journey, but not really changing things much? Are you just putting a digital wallet lipstick on an old service pig?

And second, what might be possible with a digital wallet, if we truly start with the customer? Rather than just tinkering with one or two steps in a business process, consider the end-to-end experience from the customer’s point of view. Accounting for the steps well before, and well after, the customer interacts with your product or service?

How might introducing a digital wallet, and Empowerment Tech more broadly, change the customer experience overall? How might it improve customer outcomes? And how might it even transform the business model?

Sarah knows. And she’s a design expert. I might suggest you speak to one or two of them when you are designing your digital wallet project.

They know a thing or two about real transformation.

Not just tinkering.

A masterclass argument: Consent is dead

This long read is by Eve Maler, one of the most important and respected voices in digital ID.

It’s the fourth post in a series on why consent is dead, and the path through to what matters. There are some hopeful views of what’s to come, but boy is it worth your time.

A brilliant deep dive into the complexities of consent, the charade that is digital permission today, and what’s coming.

“If privacy isn’t secrecy and it isn’t encryption, what is it?

“Even though consent has missed the mark, I believe we can push the edge of the envelope and shape a digital future where the human capacity to make an informed, uncoerced decision is respected while businesses also benefit from relationships with humans.

“Here’s to shifting from chance to control – and a promise kept.”

No, the UK government isn't planning to introduce ID cards

With what might be the best headline written this year, James O’Malley breaks down what’s going on in the UK when it comes to digital ID.

“I have to concede that letting the market figure this out may actually be a better solution. As what’s clever about letting private providers verify our identity is that from the government’s perspective, the process is technology neutral. This means that if a new and better technology comes along to do the same thing, the market can adapt more quickly.

“Having spoken to people familiar with the thinking on this, the expectation seems to be that once the Trust Framework comes into law, then it’s likely that Apple and Google will swoop in and take a big slice of the “identity provider” market, by building identity checking directly into their mobile operating systems.

“So for most of us, it’s likely that proving our identities on an online form could be as simple as the tapping a button on our phones – just as easy as using Apple or Google Pay is now.”

But then he makes the most important point of the piece:

"“And this gets at what I think is the big trade-off of this market approach, compared to creating one singular, government identity provider: It will be pretty messy, from a user-experience perspective.

“For example, individual identity providers will have to conclude individual deals with individual companies. So Tesco will have to do a deal with Yoti, and then separate deals with Apple, Google, Vouchsafe and whoever else it wants to use. So every company you need to prove your identity to could still end up handling it in an annoyingly inconsistent way”.

This tradeoff points to the very root issue of too many identity ecosystems. We want to include multiple providers so that citizens have a choice (and avoid data lock-in and abuse)… but we also want consistency.

So sing it with me: we need data protocols, not data platforms.

It’s why Empowerment Tech - with all the excitement around digital wallets and verifiable credentials - has the opportunity to untie this Gordian knot. To offer citizen choice by building on new, open data protocols to move data around, peer-to-peer. Privately, securely and with permission.

Especially moving around digital ID data, which for too long has been tied up in proprietary databases.

The UK Government doesn’t need another digital ID network or database (or cards for that matter). It needs a framework for accredited digital wallet providers, rules around governance and liability, and a thoughtful approach to the commercial models that become possible.

Based on agreed protocols. Not platforms.

And, at a minimum, the ability to accept digital wallet data from (and of course transfer digital wallet data to) the EU. Because that’s what 27 Member States have already started, using common standards.

Whatever happens in the UK is going to have to align with the EU Digital Wallet, related to the now-confirmed eIDAS2 regulations.

We don’t need ID cards. We need smart, new public digital infrastructure for digital ID.

And that means digital wallets, built using common (ideally open) data protocols.

Privacy-Preserving Corporate Information Sharing (PPCIS) - a breakthrough to make you think

Proposed by Don Marti.

“When a corporate employee uses a PPCIS browser to log in to any of their employer’s web applications, such as

shared document editor

webmail

bug tracker

Slack

“…PPCIS automatically uses its built-in AI to make a totally privacy-preserving summary of the employee’s work activity, then posts the summary to a PPCIS server using really cool math that makes it possible to identify the employer but not the individual.

“The PPCIS server then aggregates all PPCIS summaries from all the users at a company to make a report that is shared with any customer or prospective customer who visits the company’s public web site.”

Of course, PPCIS is not a real feature. But Don is jabbing at the obvious point:

“Do you think that, if it existed, corporate IT departments would leave it turned on?

“If the answer is no… why would people want privacy-preserving tracking of their personal web activity?”

Another bullseye from Don.

If you are working on, or in, AdTech, MarTech or online privacy, and don’t know Don Marti, put down your extra-hot, no-foam, double-shot latte immediately and start reading his blog.

Go on. I’ll wait.

He’s up there with Bob Hoffman and Rory Sutherland for regularly brilliant, and often the most counter-intuitive, insights about how digital marketing fails us every day.

And why privacy-preserving tracking of customers on the web is a fool’s errand.

Private AI happens when you start with developers

If you don’t know about ‘FHE’, then you will soon.

“Your chat history, your prompt data, your business IP, your creative IP, your health conditions, the details of your relationships; all being shared with Sammy, Elon, Zuck, Satya, and Sundar.”

Christian Pusateri is one of those important voices that’s worth following. To pick up the signal in the noise. And in a recent post, he describes in stark terms the issues around today’s BigTech platforms. Especially the loss of control over personal data.

He suggests that to get out of this mess we’ll need FHE. ‘Fully Homomorphic Encryption’.

“If fully homomorphic encryption (FHE) is the holy grail of cryptography, then FHE LLMs are the holy grail of AI.

“FHE LLMs will allow for full encryption of AI data, even during computation so that Gemini, OpenAI, Microsoft, X, and Meta don’t ever see your plain text.”

If you’re not paying attention to FHE, you should be.

This isn’t science fiction. The (FHE) future is here, it’s just not evenly distributed. For starters, check out privacy startup ‘Zama’. They are working on FHE at scale, but with a twist.

As the CEO Rand Hindi says, “Businesses don’t add privacy to data. Developers do.”

And so Zama has kicked off a developer-first movement towards FHE. Building a suite of easy-to-use FHE libraries and tools for developers to add at the design and coding stage of product development. Rather than at the ‘is this private and compliant?’ stage.

If Stripe does developer-first payment tools, then Zama is doing ‘developer-first privacy tools’. Amazing.

I give it 24 months before AI and FHE collide, if not sooner out of necessity as tough new data protection regulations kick in.

Because between Sammy, Elon, Zuck, Satya, and Sundar, BigTech is already involved in most of what you do online.

And that’s only getting worse with AI.

So we need smart new ways to keep our customers’ lives private. One of those answers is going to be FHE.

ZAMA, CHRISTIAN PUSATERI ON PRIVATE AI

OTHER THINGS

There are far too many interesting and important Customer Futures things to include this week. So here are some more links to chew on:

Insight: There won’t be just one EU Digital Identity Wallet READ

News: Californians can now add their mobile driver’s license to Google Wallet READ

Research: In Wallet We Trust: Bypassing the Digital Wallets Payment Security for Free Shopping READ

Insight: I Forgot My Credit Cards And… Nothing READ

News: Disney wrongful death legal case exposes potential pitfalls of automatically clicking ‘I agree’ READ

And that’s a wrap. Stay tuned for more Customer Futures soon, both here and over at LinkedIn.

And if you’re not yet signed up, why not subscribe: