eIDAS2 is a €Bn opportunity staring us in the face - but most people can't see it

If you start with the regulations, you're going to miss the biggest digital transformation since the web.

Hi everyone,

Thanks for coming back to Customer Futures. Each week I unpack the disruptive shifts around Empowerment Tech. Digital wallets, identity and Personal AI.

This is a PERSPECTIVE edition, a take on the future of digital customer relationships.

If you’re reading this and haven’t yet signed up, why not subscribe:

Most people are wrong about eIDAS2. Or at least, they are looking at it the wrong way.

Today’s post is an excerpt from a talk I gave earlier this year about the EU Digital Wallet and the hidden customer opportunity. It brings together many of the Customer Futures themes you’ll recognise around Empowerment Tech, digital wallets and identity.

But here’s the takeaway. There’s a €bn eIDAS2 opportunity staring us in the face. But you’re probably missing it because you’re looking at these new regulations the wrong way.

This week is a deep dive into why businesses today screw up customer communications, and why that’s a big problem for brands, not just customers.

We look at the EU Digital Identity wallet as a fresh and important approach for digital customer engagement. And explore why, and how, it’s going to drive new digital growth for us all.

Perhaps most importantly, we’ll talk about what this all means when you next show up late to your hotel, waving your new smart digital wallet. Spoiler: it’s going to mean next-generation VIP awesomeness.

So grab your hot drink of choice, take a comfy one, and Let’s Go.

Many experts are excited about the EU’s new digital identity framework and the innovative digital wallet approach for sharing personal data. They say it’s all about a new trusted digital ID, qualified electronic signatures and log in.

Important stuff. But those things are only part of the story.

Others closely involved with the regulations talk about e-Government. About the opportunity for advanced ‘tell me once’ services. Where government digital platforms don’t have to ask you again and again for the same data because another government department already has it.

And some talk about the power of eIDAS2 as a move towards digital sovereignty. Towards personal agency and data portability. And the right to digital privacy and anti-surveillance.

These things are also hugely important. But there’s still something missing.

Is it the role of eIDAS2 as a defence against BigTech in Europe? A response to the concentration of data power in the hands of only a few billionaires? A foil against Google, Apple, Facebook and Amazon?

Maybe. But again, these things are only part of the story.

Because it’s about all this and something much more.

Something hidden that most people can’t see. I don’t think even the EU eIDAS policy team thought about it.

To understand what I’m talking about, we need to look at eIDAS differently. I don’t mean the privacy story. Or the consent story. Or the identity story.

Let’s start by looking at customer messaging.

A hidden story about digital experiences

I was recently sent an email by my savings bank.

“We have a message for you”, it said. But of course, there was no message in the message.

Why? Because banks don’t use email to send customer messages. The compliance and fraud teams won’t let it happen. Fair point, I thought. I don’t trust email either.

The email asked me to head over to the bank’s website so that I could log in and read the important message there. Which I did, except it had been so long that I’d forgotten my login details. Again.

They asked for an account number and password that I didn’t have handy. I was locked out. Once again, Password Reset Is The New Login.

So I requested an account reset. And guess what? They sent the instructions to my bloody email. You know, the one they didn’t trust to send a message to.

I opened the email and clicked on the link to reset my account. I was on my mobile device so the browser automatically bounced me to the phone’s native app by default.

But of course, my mobile app was out of date and needed an update. So I headed to the AppStore and triggered the refresh. That took 3 more minutes to download.

I finally opened the app, which needed to send me a one-time password (OTP) by SMS. That arrived 40 seconds later, I entered the OTP code, and reset the account.

Finally, I navigated to my ‘inbox’… and read the Important Message. A pointless update to the privacy policy.

ARE YOU KIDDING ME? 9 minutes of my life wasted. I could have spent that valuable time scrolling TikTok.

And just for kicks, showing zero empathy for the customer’s emotional experience, the bank chose that exact moment to try and up-sell me another savings product.

I’m labouring this story for a reason.

This is very clearly an awful experience. But how many times do you have to do this each week? Sometimes each day?

Because it’s a familiar pattern with ALL your digital relationships. And on average, you have over 100 digital accounts to deal with. Some dead, some old, all previous, some current, few relevant.

But all messy, clumsy and fragmented.

And by the way, if you help manage a household, then you have on average ANOTHER FORTY digital relationships to look after. Employer. Car. Tax. Insurance. Pets. Health. Money 1. Money 2. Taxi. Deliveries. Netflix. Spotify…

Channel fatigue

Why is this all such a digital nightmare?

It’s simple. Because businesses only really have four ways to ‘engage’ us.

The first two are PUSH:

Message - send a crappy text, with maybe a reminder or a one-time-password

Email - send a more detailed message, perhaps with an attachment (woohoo)

Both are about interruption and so customers put up barriers. Spam detection. Filters and folders. Rules to auto-ignore.

The remaining two channels are PULL:

Websites - ask the customer to come to your home page, fill out forms, and perhaps even log in (and we know how that goes)

Apps - get the customer to download, or log in to, YET ANOTHER APP. I have so many of these now I’m literally Googling myself on my phone to find the app I need.

That’s it. Four channels.

Now, imagine you are in charge of customer engagement in a regulated business and you’re sending a message to 1.8M customers about an update.

What would YOU do?

Here’s where I’m going with this. If you look closely, you might see that a digital wallet can become a new customer channel.

More trusted than SMS. Less spammy than email. More portable than a mobile app. And more seamless than a website.

The real customer journey

Bear with me, we’ll get back to eIDAS2 in a moment.

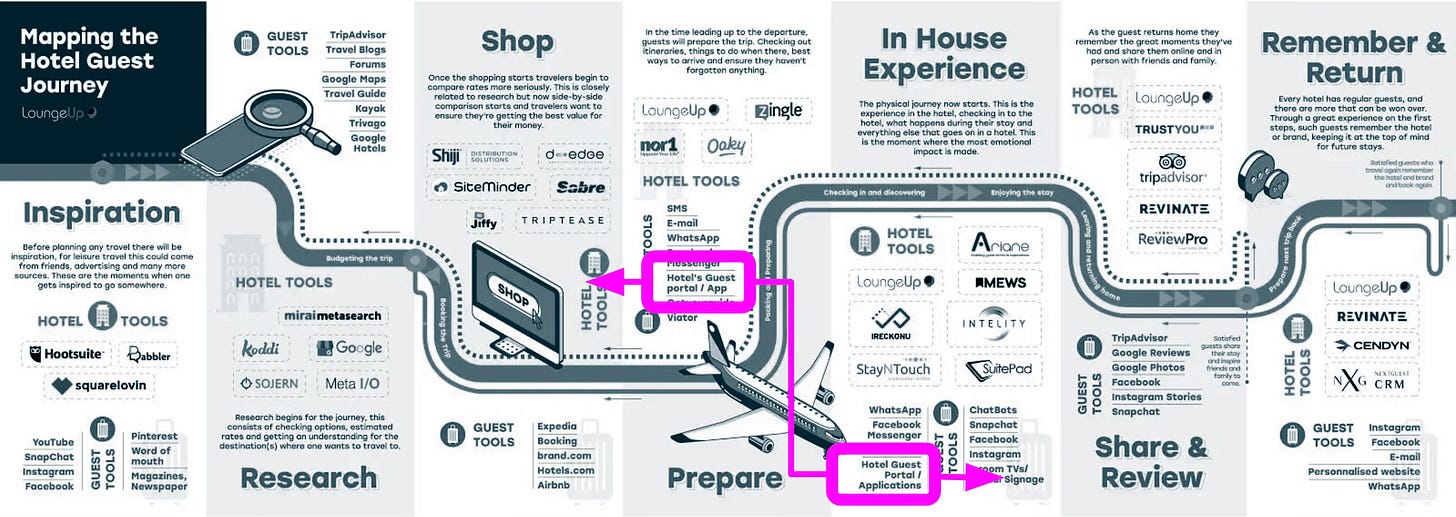

Let’s now look at an actual customer journey. Here’s a pretty average, typically complex end-to-end experience for a traveller (courtesy of LoungeUp).

Don’t worry about the details. Just look at how many digital tools and channels the customer uses across the whole trip.

YouTube, SnapChat, Facebook, Pinterest, TripAdvisor, SMS, Email, Messenger, WhatsApp, Websites, Instagram, Airbnb, Expedia, Booking, hotel and taxi portals, airline reservation systems, hotel guest apps.

It goes on.

Yet you can see the entire and ‘real’ customer journey. It’s a mess of steps, tools, data flows, forms and apps.

But now look from the hotel’s point of view.

Those purple boxes are the business’s own view of the ‘end-to-end’ customer journey. It’s narrow (only a few steps), and it’s shallow (with little information).

And you know that it’s limited because when you walk into the hotel they ask “Have you stayed with us before, sir?”

To which you say, “Yes, I was here two weeks ago, but you’ve already forgotten”.

Their idea of an ‘end-to-end traveller journey’ is laughable. Instead, we need to look at this through the lens of the customer. And through the lens of a digital wallet.

When you overlay a digital wallet onto the customer experience you can suddenly see the whole trip. All the data ins and outs, joining the dots. We can see reusable customer data and identity information that can be shared and reshared by the guest, under their control.

And from the business’s perspective, they can, with permission, see a joined-up digital customer experience. Perhaps even open up new opportunities for digital services and revenue streams.

It’s potentially a whole new ecosystem of data and experiences, but for the first time organised around the customer.

Compliance or growth?

So let’s now return to eIDAS2 and the EU digital wallet.

Right now it’s being driven into the market by regulation. As a result, it’s often seen as a compliance matter eating into profits. A cost to be minimised.

Execs will say things like

“What’s the minimum we can spend on this wallet thing without getting a fine?”

“Will it really be enforced? If so, what’s the brand and company risk if we don’t implement it?

“Will our customers really want to use one of these new digital wallets?”

“Can we just wait until the market has responded, including our competitors?

But let’s flip it.

What if there was a business growth opportunity here? Where compliance teams can help businesses to adopt the EU digital wallet and drive new business?

To turn regulation into revenue.

Let’s look at some of the growth opportunities with eIDAS2 that many folks are overlooking.

1. The Best Customer Experience Is Often No Customer Experience

Most people don’t want to spend time online with businesses. Filling out forms. Updating details. Clicking and scrolling and tapping.

They just want the outcome. The Job To Be Done. An updated account, a confirmed booking, a change of details, a check of availability.

Especially when it comes to the ‘grudge’ accounts like insurance, banking, telco and energy.

The opportunity here is for the digital wallet to become a remote control for the customer’s account. Where the customer can - outside the business’s IT firewall - update their details automatically, securely and privately. Or they can interact with a digital platform or product directly, self-service.

All without needing another clumsy or flakey web portal or chatbot.

A new, trusted digital wallet will drive business growth by removing much of the need for customer engagement in certain parts of the customer journey. Improving customer outcomes and lowering overheads like customer support.

2. A new, direct customer connection

Once customers can prove who they are using their own digital tools, like an eIDAS2-approved identity wallet, it’s going to change why, how and where customer engagement happens.

Remember, today’s businesses only have four, fragmented digital channels. Each of which has digital amnesia, forgetting who customers are as soon as they close the session.

But with a digital wallet, the customer can show up in a verified, trustworthy, persistent new digital channel. And that channel can contain verified, trustworthy data.

Over time, you can see how businesses will begin to shift their digital channel strategies. Because this new digital wallet channel will be lower-cost, lower-fraud, and lower cost-to-serve. It will be more authenticated, more trustworthy and more flexible. It will work in any context, online and off. On the phone to the contact centre or in store.

A new, trusted digital wallet will drive business growth by becoming a more seamless, more intelligent and lower-cost channel for customer engagement.

3. Recognised and remembered in any channel

As we saw above in the travel example, a new digital wallet can be used right across the customer journey. From ‘awareness and consideration’, to ‘return and close’, as customer experience experts would say.

From booking and payment, to the day-of-travel, through to the return trip.

But here’s the best bit. Not only will the digital wallet show up from start to finish, but it can carry with it a personal, private customer profile. There’s no need to limit a digital wallet to just ‘identity’ and proving ‘who I am’. But it can include portable preferences and contexts. Even customer needs and wants.

Where the customer can be recognised and remembered when and where they land on the website, or whenever they walk in.

No more “Have you stayed with us before, madam?”.

Now it can be “Welcome back madam! So sorry your flight was delayed today. As a returning guest, we’d love to offer you a complimentary upgrade so you can relax with a little more space. We have also pre-reserved you dinner for two this evening as I’m sure you’ll be hungry - just let us know.”

A new, trusted digital wallet will drive business growth by enabling smarter, non-creepy personalisation that will improve customer satisfaction, increase average revenue per customer, and over time, customer loyalty.

Wallets mean business too

But this isn’t just about new digital features for customers. Digital wallets have the potential to transform business outcomes and growth.

I’ll go further. Digital wallets will unlock a vast, new €Bn market for Empowerment Tech that helps businesses connect with customers in a whole new way.

1. The customer becomes the API

Ask any large business and you’ll hear stories about problems moving customer data around the business.

Can we trust that the data came from the other department? What’s the business case to connect these two business systems? Will we drive enough cost savings or new revenue to make it worth it?

Sadly, in most cases, the answer is ‘no’. Which is why business and IT systems remain so fragmented. And why the digital customer experience is so often broken.

“Sorry about this madam, I’ll just have to log into another system”

It’s not that executives can’t see these data issues. It’s that the business case to move customer data across the business doesn’t stand up.

But with a digital wallet, companies can give the data back to the individual. Where the customer becomes the courier of the data. Moving their personal information more seamlessly, more securely and more privately than the business can on its own.

No more need for a spider’s web of API calls between departmental IT systems. Instead, the ‘receiving’ department can just ask the customer for the data directly. And guess what? The customer becomes directly involved in the process.

The customer becomes an active participant, rather than a passive data subject.

It all builds trust and transparency. But most importantly, it’s a cheaper, faster and smarter way to move customer data around full stop.

Why use the old business data API when you can call the new Customer API?

A new, trusted digital wallet will drive business growth by lowering the cost of moving data between business units. They will lead to more joined-up customer journeys, fewer drop-off points, and more conversion in cross-sell and up-sell experiences.

2. Streaming customer reputation

The CD ‘digitized’ music in the late 1980s. But in 2009, Spotify made music truly digital.

Rather than buying specific albums, you could listen to any track, any time, from anywhere, and stream the tracks in any order. You could access fantastic new playlists with new artists you didn’t yet know.

With a trusted digital identity wallet, the customer can quickly become the most trusted source of their personal data. And we’ll move from batch data collection of customer data (via forms and APIs) to streaming customer data.

When the business needs some customer information, it will be the fastest, most accurate and most compliant way to just ask the customer directly. With a new verified and trustworthy customer data source, digital wallets will transform CRM and Customer Data Platforms.

But won’t businesses abuse this new customer channel and ask for more and more data? Possibly.

But remember, the individual will be in control of what’s shared, with whom and when. And there will be an auditable record of those transactions - who asked for what, when, how and why.

These secure audit trails are going to keep businesses honest. And mean that customers themselves can take action when they (or the wallet on their behalf) spots any overreach around personal data.

And customers will have all the digital proof they need.

A new, trusted digital wallet will drive business growth by enabling businesses to collect the right data at the right time, from the right customer sources. That means smarter customer profiles for personalisation, more seamless customer interactions with lower costs, and higher trust in the brand.

3. The next wave of digital transformation… on the customer side

Today, we’re only really doing ‘digital transformation’ on the business side. It’s all about new customer portals, online forms and an explosion of new apps.

But these digital advances are all developed by, and for, the business. But with a new digital wallet, like that proposed by eIDAS2, we can introduce the next generation of digital transformation.

Delivering automation and data intelligence on the customer side, not just within business IT systems.

What previously required a call to the contact centre can now be automated by the customer themselves. What previously required re-entering customer data across different points of the customer journey can now be done quietly, securely - and auditably - by the digital wallet in the background.

We can ask the customer to bring their own verified personal data with them to the business process. Rather than collecting the raw data over and over again. And we can create entirely new customer journeys, between and across business departments that weren’t possible (or visible) before.

Because now customers themselves can stitch together products and processes needed to meet a specific outcome.

A traveller can say “Just check me in.”

A saver can say “Please switch my bank account”.

A patient can say “Please share my latest scans with my physio.”

A new, trusted digital wallet will unleash new levels of digital transformation, but this time on the customer side.

Empowerment means AND not OR

Customer empowerment doesn’t mean handwaving about digital sovereignty, personal agency and data portability. Nor is it about citizen rights to digital privacy and anti-surveillance.

It’s about digital growth. About smarter customer engagement. And about better business.

It’s an AND, not an OR.

It’s about citizens AND government. Consumers AND business. About compliance AND digital growth. Where a digital ID can enable more compliant use of digital ID. But with a lower cost-to-serve and lower risk.

Where a private, personal profile can mean customer automation and smarter, more acceptable levels of personalisation. And where a digital wallet can mean better customer conversion, new revenue streams and even a new customer channel.

So what do you see in the picture above? The duck or the rabbit?

And with eIDAS2, do you see compliance or growth?

Because the new EU digital identity wallet is really about Empowerment Tech. About digital trust. And about a hidden €Bn market opportunity for a new customer channel which can completely reimagine customer engagement.

It’s just that most can’t see it yet.

Because they’re looking at it the wrong way.

Thanks for reading this week’s edition. Stay tuned for more Customer Futures soon, both here and over at LinkedIn.

And if you want to learn more about the future of Empowerment Tech, digital wallets and customer engagement, then why not sign up:

Absolutely brilliant piece mate and red hot given Apple's announcements. Your vision in this space is a genuine inspiration.