Plaid’s ‘Layer’ feature is a step towards Empowerment Tech, and Fraud teams are burning out - it’s time for customers to help

Plus: Is it time for multi-factor verification (MFV), The hidden €Bn opportunity with eIDAS2, and LLMs are commodity infrastructure - a perfect fit for Empowerment Tech

Hi everyone, thanks for coming back to Customer Futures. Each week I unpack the disruptive shifts around digital wallets, Personal AI and digital customer relationships.

If you haven’t yet signed up, why not subscribe:

Hi folks,

Another knock-out week for Empowerment Tech (ET).

Voltaire once said (something like): ‘I will judge you not by your answers, but by your questions.’

As we see more and more ET projects emerging, and more providers coming to market, it’s more important than ever that we ask the right questions. Not just shout about having the right answers.

Because too many folks are starting in the wrong place.

Or rather, they are starting with the wrong questions.

Asking things like

What DID methods should we use?

What credential formats should we include?

What’s the exact form factor for the wallet?

Which vendor should we partner with?

Those are excellent questions. But they shouldn’t be your first questions.

At MISSION we have been building and selling digital identity, digital wallet, decentralised ID/SSI and Personal AI solutions for over 10 years. We’ve made the mistakes and have the scar tissue to prove it.

And we’re now borderline obsessive about bringing the ET market to life.

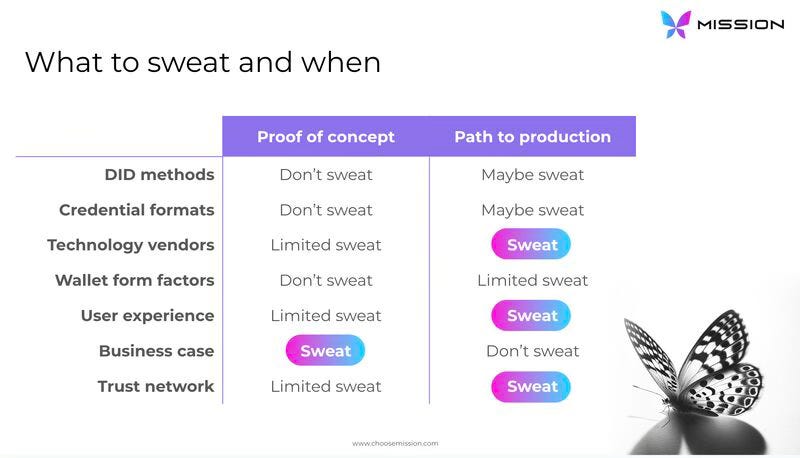

So the title picture for this week’s newsletter is one of the slides from MISSION’s recent webinar. It’s our ‘sweat matrix’. What to sweat with decentralised ID. And more importantly, when to sweat it.

The webinar was about 'How to create a decentralized reusable identity strategy'. I highly recommend watching.

So when you next have a conversation about Empowerment Tech, or plan your ET project, think carefully about the questions you are asking. And which of them you actually need to answer first.

MISSION is here if you need help. Do get in touch.

Of course, it’s all about the future of being a digital customer. So welcome back to the Customer Futures newsletter.

In this week’s edition

We already have MFA, is it time for multi-factor verification (MFV)?

The hidden €Bn opportunity with eIDAS2

Plaid’s ‘Layer’ feature is a step towards Empowerment Tech

LLMs are commodity infrastructure, not platforms or products - a perfect fit for Empowerment Tech

Fraud teams are burning out - it’s time for customers to help

… plus other links about the future of digital customers you don’t want to miss

Let’s Go.

We already have MFA, is it time for multi-factor verification (MFV)?

Multi-factor authentication, or MFA, is a pretty well-understood flow for businesses to check that it’s the same customer returning to a digital service.

One-time passwords and device biometrics are used to match the service to the correct person.

But what about the verification side? What about using multiple sources of data to check it’s the right person in the first place?

I love this idea from Susan Morrow, Head of R&D at Avoco Secure.

“Any quick Google search for stats on social engineering will throw up shocking data. I'm not even going to mention deep fakes and identity. Verification, as it is, is failing our people and our businesses. We must do better.

“In the real world, social interactions use multiple variables to determine credibility and to verify the other(s) in the relationship.

“This is where I discuss why "multi-factor verification," or MFV for short, follows the same trajectory as authentication.

“This trajectory will provide a more robust way to verify people. In the real world, we often use subtle (sometimes not so subtle) clues of trustworthiness. In the digital world, we can do the same, maybe not quite as subtle, but all the same, we can apply multiple factors to verify someone, and we can step up or build risk into the decision-making.

“This check may be to connect to a bank ID using open banking, a CRA check, or something else; your imagination is the only limit.

“In this way, verification is following in the footsteps of its cousin authentication. Adding trust to transactions is more than just a one-stop selfie shop. Trust is earned, and multiple factors may need to be considered before this trust is assured.”

Why do I love this view of ‘MFV’ so much? Because it lies at the heart of the promise of Empowerment Tech.

Susan writes about using multiple sources of data, including bank and credit reference checks, to verify an individual. Makes sense.

But for a business, those APIs are expensive, often complex and can take time to integrate.

What if there was an easier, more secure and private way to do MPV? Rather than call a myriad of 3rd party data APIs, just ping The Customer API (cAPI?) instead?

Sending a data request directly to a customer’s digital wallet is already relatively simple.

The individual can scan a QR code, tap their mobile, or even just click on a link. It’s a simple step to trigger the wallet into action, describing the details of what data is being asked for and by whom.

This way the individual can always see what data is requested. They can always decide what to share (or not). And - critically - they can audit who has asked for what, when and why.

‘MFA’ has been broadly adopted in most industries, and by most large companies and online platforms. Especially those businesses targeted for fraud, like financial services.

‘MFV’ is simply the other side of the coin, and represents a massive opportunity for the digital wallet market.

It might just be the smartest way to think about digital wallets and verifiable credentials full stop.

Where, as Susan points out, we can add trust to transactions, rather than relying on a one-stop selfie check.

Empowerment Tech is all about MFV. And I have a feeling that it’s soon going to be adopted as widely as MFA.

The hidden €Bn opportunity with eIDAS2

Earlier this month I gave a talk about eIDAS2. About how a universal digital identity wallet in the EU is a game changer.

But I took a different perspective from many. I pointed out that there's a hidden €Bn opportunity that most people can't see.

Case in point: TechCrunch just wrote about the EU Digital Identity wallet. It’s a pretty good summary of the regulations, the tech and the benefits.

But like most, the piece overlooks the real opportunity.

eIDAS2 is not just about digital government. It's not just about new levels of data protection and privacy. And it's not just about lower costs to check IDs.

Nor is it about the opportunity to reduce fraud. It's actually all of those.

But also much more.

Most people are missing the vast opportunity to enable a new, secure and private digital connection with customers.

Yet the business response is likely to be about compliance. And therefore an overhead to be minimised.

But if you re-frame the digital ID wallet as an opportunity for digital growth, you can see an entirely new approach to customer engagement.

Unlike email and SMS, the EU wallet won't be spammy. Unlike online forms and clumsy mobile apps, the EU wallet won't forget who you are every time you use them.

Instead, the wallet will remember. The customer will be in control. And individuals will be able to mute or even disconnect businesses that disrespect this new digital customer channel.

When the customer can ‘turn off’ a business whenever they like using this new private and secure customer channel, it fast becomes a race to the top on digital trust, and on customer value.

It will be 100x better, and smarter, than today’s digital customer channels like SMS, browsers and apps, which are interruptive, spammy, clumsy and untrusted. Those a race to the bottom for attention.

But there’s an ever more important - and unexpected - point to make about digital wallets.

Once customers have their own private and secure new digital tools to engage with businesses, it's going to be the customers themselves that will redefine the customer experience.

And that's going to unleash a new €Bn market opportunity for brands who can respect the new customer connection.

But only for those who can see it.

TECH CRUNCH, JAMIE’S EIC TALK (requires subscription)

Plaid’s ‘Layer’ feature is a step towards Empowerment Tech

Plaid is one of the world’s largest IDV and customer data companies. And they are expanding in all sorts of markets.

They’ve now just announced that they’re going after customer onboarding. They claim that their new ‘Layer’ feature increases end-to-end sign-up rates by up to 25%. Which is a big deal for companies who today are spending $MM to improve onboarding by only 2% or 3%.

Plaid can now use the customer’s phone number to see if the individual has previously been through an ID check at another Plaid-powered business. If they already are part of the ‘Plaid network’.

If so, the user is given the option to authenticate (via one-time password, mobile device check etc.), and decide if they agree to share the relevant ID data requested. Plaid then serves up that customer data to the business, from names and dates of birth, to bank account details and social security numbers.

Plaid says that this process reduces onboarding time by nearly 90%, and offers a drastic uplift in conversion.

Pretty impressive.

Stripe offers a very similar platform called ‘Link’. If you have previously checked out at an online merchant that uses Stripe, then you are now in the ‘Stripe network’. You simply check a box for Stripe to remember your ID and payment information for next time.

Then whenever you need to check out at a merchant that supports Link, you just enter your mobile number, authenticate from your device, and voila, all your data is pre-entered for you.

It’s a one-tap experience.

Both Plaid and Stripe have nailed the ‘remember my data’ customer feature. And as a result have positioned themselves brilliantly for their respective markets (ID verification, and checkout).

Why does this matter?

Because this is all about ‘ID networks that store data’. And therefore all about the business side.

Don’t get me wrong. These new features are amazing. Especially because they improve things for both the customer (smoother experience, and faster) and the business (better conversion at lower cost, and faster onboarding).

But what if we take this idea even further? What if the customer could carry that pre-verified data with them themselves?

And not just the onboarding data (Plaid). Not just the checkout data (Stripe). But both, and much, much more?

What about adding other data? Like an entitlement to an employee discount? Or proof of a related account? Or a VIP status?

Because a digital wallet can hold and share much more info than identity and payments.

But there’s even more.

In both Plaid and Stripe ‘remember me’ flows, the user must be sent a password, or a token, to prove it’s them. Why not have that step already baked into the checkout or ID transaction? Where the user can simply scan a QR code or tap a link? Or even do it in person - in a branch or store - and offer the same experience as online?

That all now becomes possible with Empowerment Tech. With Digital Wallets, Personal Vaults, and Personal AI.

Joining another ‘data network’ is an excellent first step by Plaid. It improves conversion, improves the customer experience, and tackles fraud.

But ‘being remembered’ doesn’t just need to happen on the business side. It can happen on the customer side too.

Plaid’s Layer feature is just another small step towards Empowerment Tech. Towards the customer holding and sharing their own data themselves.

And towards a much more open digital ecosystem that empowers individuals in their daily lives.

PLAID’S ‘LAYER’, STRIP’S ‘LINK’

LLMs are commodity infrastructure, not platforms or products - a perfect fit for Empowerment Tech

Ben Evans hits the nail on the head in his latest analysis of Apple Intelligence.

“Apple is, I think, signalling a view that generative AI, and ChatGPT itself, is a commodity technology that is most useful when it is:

Embedded in a system that gives it broader context about the user (which might be search, social, a device OS, or a vertical application) and

Unbundled into individual features (ditto), which are inherently easier to run as small power-efficient models on small power-efficient devices on the edge (paid for by users, not your capex budget) - which is just as well, because…

This stuff will never work for the mass-market if we have marginal cost every time the user presses ‘OK’ and we need a fleet of new nuclear power-stations to run it all.

In other words, LLMs are a new commodity tech, not a product or platform. And that the simple economics of AI now means we must run most AI tech at the edge. On device.

Makes sense.

But whose AI will it - and should it - then be?

“Incumbents always try to make the new thing a feature. Google and Microsoft have spent the last 18 months spraying LLMs all over their products, and so has every enterprise SaaS company: my old colleague Steven Sinofsky says that ‘every text box on the internet is going to get an LLM’.

“Apple is doing something slightly different - it’s proposing a single context model for everything you do on your phone, and powering features from that, rather than adding disconnected LLM-powered features at disconnected points across the company.

“…that’s really the single core question about the future of Generative AI - is this a new general purpose tool, where one product from one company does the work of hundreds of pieces of software from hundreds of companies, or is this a generic technology that will enable features inside products from hundreds or thousands of companies?”

THAT is the killer point. LLMs become generic tech that enables features inside existing products. To meet customers where they already are.

Which is on their existing device. In existing customer relationships.

Folks are slowly coming around to the idea that LLMs are really just commodity infrastructure, not platforms or products. And are a perfect fit for running Empowerment Tech at the edge.

Fraud teams are burning out - it’s time for customers to help

There are plenty of reports about how fraud is exploding. Few, however, have pointed to how fraud teams are doing.

Not well, it seems.

GBG have just released their 2024 Global Fraud Report. Pointing to the harsh nature of fraud, and its impact on the businesses, their leadership and their teams.

“Fraud can seem like an unstoppable machine. As fraud reaches industrial levels, breaking out across businesses, sectors and breaching national boundaries, the consequences can be very human.

“Seventy-five per cent of fraud professionals have experienced burnout in their job due to the rising levels of fraud”.

Wow.

I recently wrote the exec summary for Ping’s report on the same topic. And the stats around fraud are no less frightening. Because most fraud and IT decision-makers are ‘very concerned’ that AI technology will significantly increase identity fraud this year.

You can understand why they are burning out.

More positively, GBG has found that over 80% believe that ‘cross-sector collaboration on identity intelligence sharing can help to defeat fraud’.

Of course they do. Because that’s the business PoV. The organisation’s side of things.

But what if the customer could help?

I wrote about exactly this idea in a recent post entitled: “I don’t just want my bank to fight fraud - I want my digital wallet to help too.”

Where the individual can use their Empowerment Tech digital tools, like a digital wallet, to prove that it’s really them when they show up online, on the phone or in-store.

Fraud teams are burning out because they’re fighting with one hand tied behind their back. Hoping that they can counter Baddie AI with Goodie AI.

Today, only half the market is tackling the $bn fraud problem.

It’s time for customers to step in with ET and help too.

GBG REPORT, DIGITAL WALLETS AND FRAUD

OTHER THINGS

There are far too many interesting and important Customer Futures things to include this week. So here are some more links to chew on:

Podcast: Germany’s Wallet Strategy, Interop Profiles and Big Tech (SSI Orbit) WATCH

Post: Synthetic data is as good as real – next comes synthetic strategy READ

Article: How millions of users lose control over their data via links READ

Post: The EUIDW Payment Wallet is coming! So is the likely backlash READ

Article: Web3 Has Given Us the Chance to Own Our Online Data, But Do We Want It? READ

And that’s a wrap. Stay tuned for more Customer Futures soon, both here and over at LinkedIn.

And if you’re not yet signed up, why not subscribe: