The new vital AI fraud signal: ‘Customer Present’ vs. ‘Customer NOT Present’

Plus: Rethinking employee password resets with the EUDI Wallet

Hi everyone, thanks for coming back to Customer Futures.

Each week I unpack the disruptive shifts around Empowerment Tech. Digital wallets, Personal AI and the future of the digital customer relationship.

If you haven’t yet signed up, why not subscribe:

Join us in person - Customer Futures Meetups!

Are you curious about Personal AI, digital ID and digital wallets? Or are you already working on Empowerment Tech?

Friday 31 October (tomorrow) - London lunch!

Join us for an impromptu casual lunch in central London at 12pm to talk about Personhood Credentials, Verifiable Relationships, AI agents and more

We’ll be discussing the new First Person Project with Drummond Reed, co-author of the DID spec, SSI OG, and pioneer of the Trust Over IP Stack

Reply to this email or DM me for details

Wednesday 10th December - the Christmas Customer Futures Meetup

Join us for the annual Customer Futures Christmas bash

Main bar, The Hoxton Hotel Holborn from 6pm (here)

Looking forward to seeing you there!

Hi folks,

We have to talk about trust. Again.

But that’s hard. Because if you ask 16 people what that means, you get 16 different answers.

Here’s mine.

We need to separate out:

1. ‘Expertise trust’ - will you do what you say you will, safely?

from

2. ‘Motive trust’ - are your interests aligned with mine?

This week, we have a textbook example of the difference with OpenAI.

Now generally, we can probably agree that OpenAI is a team of experts. Cutting-edge models and capabilities.

Expertise Trust.

The question then becomes: are their incentives aligned with mine? What’s behind those ChatGPT recommendations? Whose interests are they serving?

Motive Trust.

Ok. So far, so Silicon Valley. Prioritising ‘product-led growth.’

But now look again at this week’s screw up with the OpenAI browser ‘Atlas’. The security snafu where their flagship new browser was storing “functional, unencrypted oAuth tokens in a SQLite database.”

In other words, making your access tokens - your secrets on the web, giving you access to sites and services - queryable and usable by anyone.

Not ideal. Not secure. And not a great day for the Atlas team that literally has $bns in funding.

But it feels like something bigger. A lapse in security skills, experience and expertise. I feel strongly that they have put themselves back here.

It speaks to not paying attention. To poor governance. To a lack of security.

They were already clinging on to trust with Sam Altman in the courts. Now what happens when they try to cling on to the coming security audits?

Being good at something isn’t enough any more. You need to win with both expertise trust and motive trust.

Because very soon it’s not just going to be ‘AI and payments’. It’s going to be AI and your digital life. Your personal data.

So there’s never been a more important time to help shape the future of being a digital customer. So welcome back to the Customer Futures newsletter.

In this week’s edition:

Paypal Wallet + ChatGPT = ?

What are we even doing anymore, Meta?

Rethinking password resets with the EUDI Wallet

The moment leadership calls customer service a ‘cost center’ they’ve already lost

The new vital AI fraud signal: ‘Customer Present’ vs. ‘Customer NOT Present’

… and much more

Grab an espresso, a comfy corner, and Let’s Go.

Paypal Wallet + ChatGPT = ?

PayPal just integrated with OpenAI. And the stock jumped 14%.

Why?

Because folks are betting that the payments giant just cracked open one of the hardest parts of agentic commerce. Trust.

Simon Taylor makes the key point:

“Starting next year, 700M+ weekly ChatGPT users can buy directly through the AI interface using PayPal.

“The clever bit? Both sides of the transaction are verified — merchants and consumers. That’s the unlock.”

Exactly. While everyone gets excited about ‘AI-powered checkout’, this is actually a move to verify both humans and businesses inside the conversation itself.

And that’s where the battle for Agentic Commerce is heating up. Walmart, Booking.com, Visa, and a bunch of others are all racing to wire up chat-based payments.

But Simon’s right. This isn’t about who integrates with what anymore. It’s about who can verify who.

Think of it like building a city. Everyone is running to build the shiniest, the tallest new AI payment skyscrapers. But the foundation stones are missing. Trust, risk and liability.

And when that digital ground shakes - maybe from a swarm of invisible bad actor agents, or from a public brand meltdown when an agent misbehaves - will those AI skyscrapers stay standing?

Without the Agentic ABCs in place - Know Your Agent, Know Your Business, Know Your Customer (h/t to Dave Birch for that one) - those foundations look shaky indeed.

Now, PayPal does bring something. Decades of experience in verifying both merchants and consumers. A balance sheet big enough to underwrite some of the risk. And a brand still broadly trusted by mainstream users.

But let’s be honest. This isn’t a silver bullet. It’s a baby step.

Fraud will still happen. Verification will still be patchy. And all we’re really covering here is payment data.

In fact, PayPal’s integration with OpenAI is part of a whole set of new partnerships announced over the last few months

Perplexity - with access to 22M users

Google - access to 5B consumers

Mastercard - 3.1B cards

And now OpenAI - 900M people

But remember, all this is about payment transactions. And accessing PayPal’s 36M merchants, and all that SKU data to inject into the chat.

Yet the real test of A-Commerce won’t just be about who can process the money. Stripe, Visa and Mastercard are already busy nailing that one down.

Rather, it’ll be about who can trust the personal data that agents exchange before the payment ever happens.

So PayPal Wallet + ChatGPT = a bit more trust around payments.

We’re still miles away from the true promise of Agentic Commerce. Where digital identity wallets sit alongside payment wallets.

And where trust moves with the person, not just the transaction.

What are we even doing anymore, Meta?

I’ve long said we’re in a digital ads bubble. Peak ads.

Much like the subprime lending bubble nearly 20 years ago. In the great crash of 2007, we had no idea what assets were owned by whom, where, or what they were worth.

Lending wrapped in lending wrapped in lending.

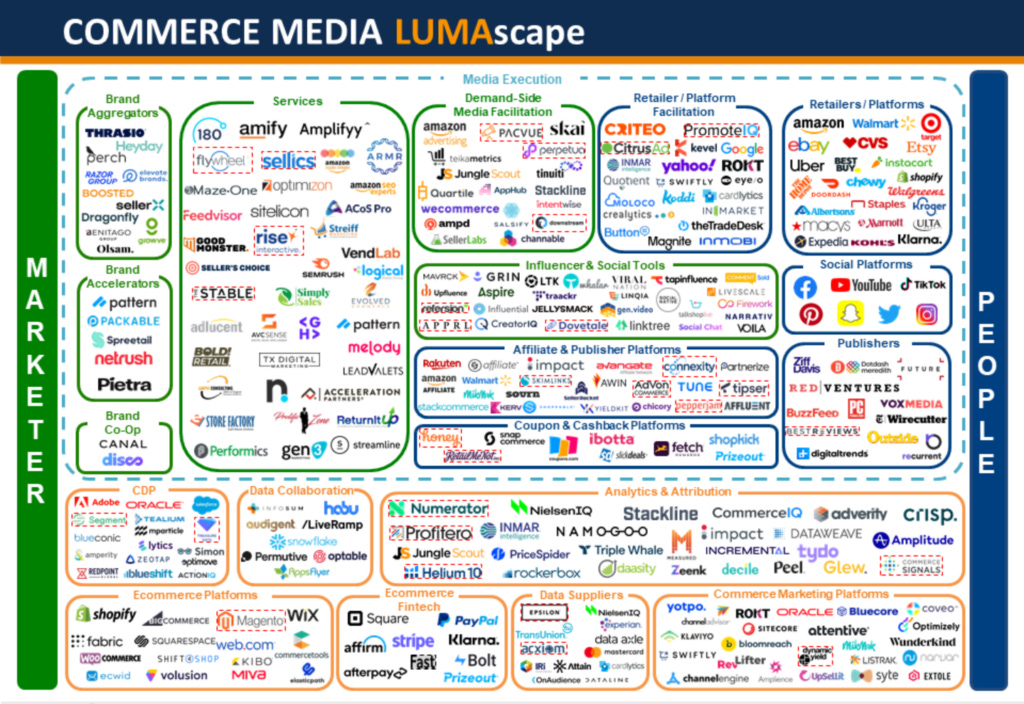

The picture below is the ad tech landscape today. Full of random segments and opaque data value chains and acronyms nobody understands any more.

Derivatives, obfuscation, high frequency trading. Ring a bell?

Peak ads.

Where we have no idea what digital ads work, where or why anymore.

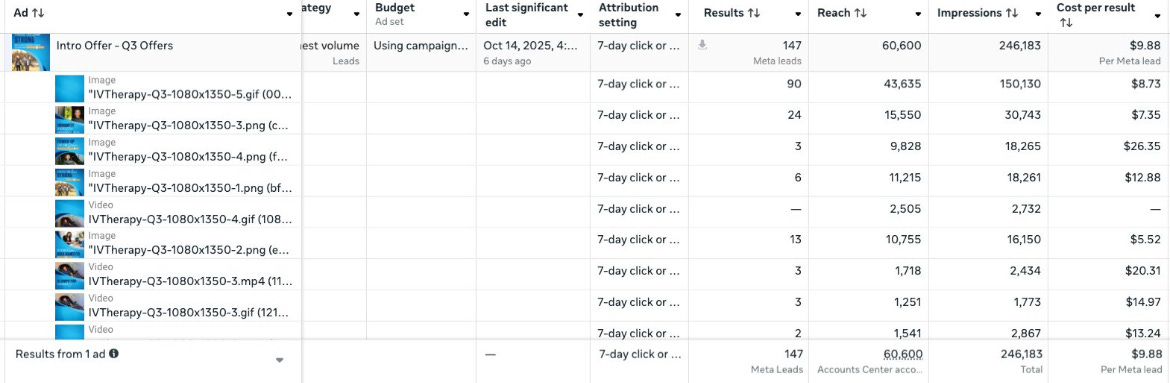

Exhibit A: Kevin Pierce accidentally uploaded a random blue square to a Meta ad, instead of the real image he meant to post.

Bizarrely, it outperformed his other digital ads by a mile.

“Accidentally uploaded a gif as an image so we’ve been running a blue square as an ad for like 2 weeks.

“Best ad in the campaign bringing in 67% of the leads.

“What are we even doing anymore Meta?”

After the peak, comes the disruption.

So what’s coming for digital ads? Conversational commerce and AI Agents.

Remember, your AI agent won’t watch ads. And won’t be nudged into FOMO with an emotional campaign. Commerce within AI chat promises to change the e-commerce funnel forever.

It won’t be SEARCH anymore. It’ll be FIND.

I’m already having chats with folks right across the adtech market about what’s coming.

Many are excited. Most are terrified. They can feel it coming. Even if they can’t see it.

But we all need to ask questions when a random blue box brings in two-thirds of the digital leads and we don’t know why.

Rethinking password resets with the EUDI Wallet

Yes, there are lots of EU Digital ID Wallet PoCs and pilots. But this one is interesting.

Many digital ID projects talk about filing taxes. Or maybe renting a car, making a payment or booking a flight. And a small number talk about digital signatures.

But I’ve seen few eIDAS2 wallet projects looking at use cases inside a business. With employee workflows.

Wallet provider Lissi recently partnered with Atruvia and Ping Identity on a PoC to help solve a high-frequency and expensive use case for corporate IT.

Secure password resets.

“Instead of fallback call centers and manual checks, we used the EUDI Wallet tech stack. Here’s a breakdown of how the solution was designed and tested:

Credential Setup: Atruvia created a standardized Employee ID credential template, containing core identity attributes (e.g., employee ID, role, organizational affiliation).

Credential Issuance: Employees were issued this digital credential via the PING Identity platform and stored it in their Lissi Employee Wallet — a compliant EUDI Wallet prototype.

Reset Request: If a password reset was needed, employees were prompted to share their employee credential via the Lissi Employee Wallet.

Employee Authentication & Reset: After secure authentication with the wallet, the system allowed them to securely set a new password, restoring access to their corporate account.”

It’s interesting because it’s one of the lesser-spotted animals in the identity kingdom. A high-frequency, high-value use case. Not opening a bank account or updating your taxes once a year.

I wonder if this is an excellent, hidden adoption route for the EU Digital ID Wallet. And a nice defence play against the Big Tech players. How many brands will be happy to use Google or Apple Wallets for corporate password reset?

Now, it’s only a PoC. There are thousands of them.

But this kind of thing shows just how powerful an Empowerment Tech approach can take. How powerful a digital wallet with verifiable credentials can be.

And - critically - how ET can extend and enhance existing systems.

Not replace them.

The moment leadership calls customer service a ‘cost center’ they’ve already lost

Baker Johnson is on fire with this brilliant view on CX:

“Here’s the philosophical divide that kills companies: treating customer experience as an expense to minimize rather than an investment to maximize.

“When you frame support as a “cost center,” every decision flows from scarcity thinking; like: how do we spend less, deflect more, handle customers faster, reduce headcount, optimize for efficiency over effectiveness?”

But then he lands the most important point, about why so many businesses lose before they’ve even started:

Your language reveals the philosophy

Your philosophy determines the customer experience

Your customer experience drives the business outcomes

Here are some other examples of business language that betray a company’s real view of how they think about the customer.

Calling people ‘users’

Saying you ‘own the customer’

Saying that marketing is about ‘targeting’ and ‘lock-in’

Because all of these words are about doing things TO customers. Not doing it WITH and FOR them.

This language happens when a business optimises for the transaction. For short-term goals.

But when a company optimises for the customer relationship - for connection, for understanding and customer experience - they can build long-term value and customer loyalty.

And ultimately more profit.

Baker is right. Get the customer framing right - the language right - and you win.

The new vital AI fraud signal: ‘Customer Present’ vs. ‘Customer NOT Present’

The ‘good actors’ (that’s us) are pretty bad at identity.

The problem is that the ‘bad actors’ (that’s them, and soon the MalBots) are getting quite good at it.

We need a new way to think about proving stuff about people, organisations and things.

And fast.

Why?

A million reasons. But I keep coming back to one of my favourite stats:

75% of staff working in fraud are burning out, according to a report by GBG.

Wow. We’re not shouting about fraud rates. Or the $bns lost. Or the KYC failures. We’re talking about the people whose job it is to stop the mess.

They are exhausted. Worn out. Doing their best with crappy tools.

Fighting a tsunami inside a hurricane with an umbrella, while a regulator looks over their shoulder and complains about the rain.

Einstein once said that the group that invents the problem can’t be the one to solve it. That we need outside thinking to fix things.

I believe more than ever that the ones to solve much of this fraud - the ones ‘on the outside’ - are the customers themselves.

For years, businesses have had to do all the lifting because they were the only ones with the data. They were the ones with the ‘signals’.

But what if customers have the data? And bring the signals themselves?

Proof of customer

Proof of account

Proof of purchase

Proof of digital relationship

Proof of intent

My goodness, we’d have a new way to interact, and with much lower fraud rates. And fast.

How do we know? Because credit cards already do it: Card Present vs. Card NOT Present.

If you pay in store, it’s much less likely to be fraud, so the payment companies charge a lower rate. If you pay online or over the phone, it’s more likely to be a bad actor using your card details without your permission. And so the payment companies jack up the rates, to cover the fraud and chargebacks.

My point is that we are about to do the same. With customer credentials.

We’ll call it: ‘Customer Present’ vs. ‘Customer NOT Present’

If the customer (or their delegated AI agent) is involved, we’ll have a digital signal for that, and it’ll carry a lower fraud rate. If the customer isn’t involved, and someone is just presenting my personal data over the web, over the phone, or via a random AI Agent, then it’ll be accepted, but carry a much higher fraud rate.

Businesses will be able to make sense of these signals, and act accordingly. Perhaps asking for more data. Or stepping up authentication for those untrusted transactions.

For those paying attention, note that the customer signal, that verifiable credential, can be delegated to an AI Agent too. More on that coming soon.

But for now, know that

Fraud is about to get MUCH worse, because we’re not very good at ID today

We need a completely new way to think about it - today’s approach and tools won’t work

Customers themselves will be the answer - because they’ll can bring their own data and signals to every transaction - where we can reduce all that Customer NOT Present fraud

Looking for expert views on digital ID? Check out the Digital Identity Forum

Are you looking to stay up to date on the latest digital identity market? Check out the Digital Identity Forum.

“It’s a new dedicated community bringing together the digital ID ecosystem, and facilitating discussions that translate to action.

“Community members get access to information on the latest news and headlines, events, jobs, expert conversations, podcasts, and more.”

It’s been set up by Colin Strasburg and Pavol Hrina, two experts in the field. Well worth following both of them, and the new DIForum.

OTHER THINGS

There are far too many interesting and important Customer Futures things to include this week.

So here are some more links to chew on:

News: Apple says US passport digital IDs are coming to Wallet ‘soon’ READ

Idea: This new IEEE standard aims to eliminate annoying cookie banners READ

Paper: Everything you need to know about KYA READ

Survey: Only 17% fully trust brands to manage their identity data READ

Post: Is Your AI Browser Actually a Firewall? READ

Idea: From AI in Wallets to Wallet for AI Agents READ

And that’s a wrap. Stay tuned for more Customer Futures soon, both here and over at LinkedIn.

And if you’re not yet signed up, why not subscribe: